Overview

Freelancers often face significant challenges in managing inconsistent income and expenses, making effective budgeting tools essential. Understanding these common concerns, it becomes clear that platforms like Kulud can provide valuable solutions. By automating expense tracking and enhancing financial oversight, Kulud addresses the need for reliable financial management.

Furthermore, expert insights and user testimonials underscore the transformative effects these tools have had on freelancers' economic stability and efficiency. This means that, with the right tools, freelancers can achieve a more secure financial future.

We encourage you to explore Kulud and see how it can support your financial journey.

Introduction

Freelancers often find themselves navigating a complex financial landscape characterized by fluctuating incomes and unpredictable expenses. Understanding these challenges is crucial for managing finances effectively. As the gig economy expands, the importance of effective budgeting tools tailored specifically for independent workers becomes increasingly evident.

Platforms like Kulud and applications such as YNAB (You Need A Budget) are revolutionizing the way freelancers manage their finances. These tools offer features that streamline expense tracking and automate tedious tasks, directly addressing the concerns many freelancers face. Furthermore, with the rise of freelancing projected to reshape the workforce by 2027, knowing how to leverage these tools is vital for achieving financial stability and success.

This means that understanding budgeting strategies is not just beneficial; it is essential. This article delves into the essential budgeting strategies and tools that empower freelancers to take control of their finances, ensuring they can thrive in an ever-evolving economic environment. We encourage you to explore these platforms and discover how they can enhance your financial management.

Understanding Budgeting Tools for Freelancers

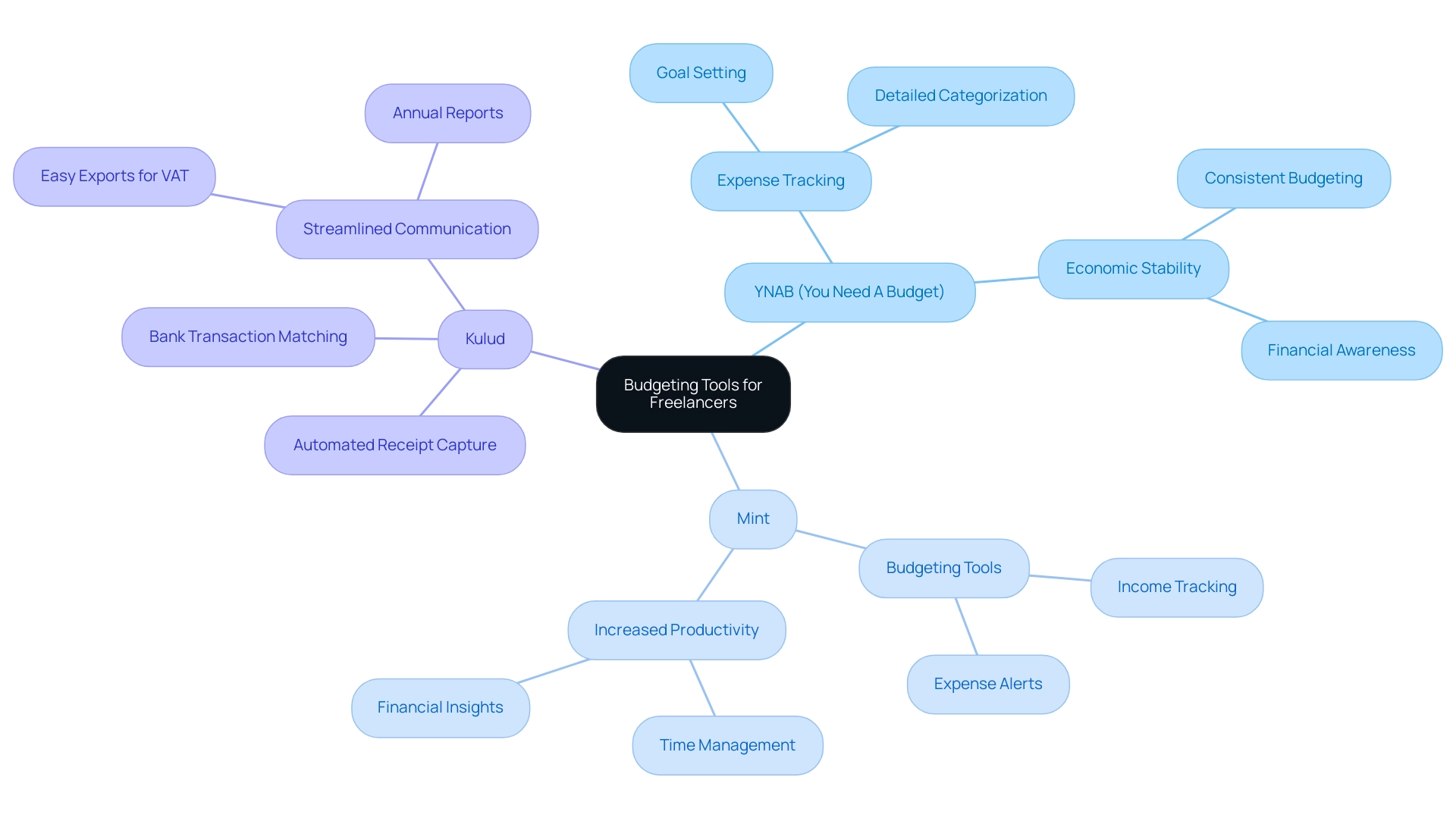

Freelancers often encounter unique monetary challenges, including inconsistent income sources and fluctuating costs, complicating effective management. To address these concerns, budgeting tools specifically designed for self-employed individuals are essential. Applications like YNAB (You Need A Budget) and Mint empower independent workers by enabling meticulous tracking of income, categorization of expenses, and establishment of monetary goals.

These budgeting tools not only assist in the budgeting process but also automate various aspects, significantly enhancing economic stability.

Furthermore, the integration of budgeting tools with platforms like Kulud further simplifies expense management. Kulud’s features, such as automated receipt capture and bank transaction matching, allow independent workers to effortlessly manage their finances by connecting their bank accounts and automating the extraction and categorization of receipts and invoices. Additionally, logging in with a business email and adding multiple accounts is straightforward, ensuring that independent workers can easily consolidate their financial data.

This means that independent workers can dedicate more time to their primary work rather than getting bogged down by administrative tasks. The collaboration between budgeting tools and Kulud's automated expense management solution is crucial, especially as research indicates that independent workers will constitute a significant segment of the American workforce by 2027, influenced by socio-economic changes. The rise in independent work is underscored by the economic decline, prompting numerous skilled individuals to pursue adaptable job options.

Current data reveals an increasing number of self-employed individuals utilizing budgeting tools, with many reporting enhanced oversight and stability. For instance, the use of expense management applications has surged, reflecting a broader trend toward economic literacy among self-employed individuals. Case studies demonstrate that independent workers who leverage these tools experience a marked improvement in their financial management capabilities, leading to greater peace of mind and increased productivity.

Notably, testimonials from satisfied customers, such as Georgi Knyazhev, underscore the transformative impact of Kulud on their accounting processes, enabling them to save time and streamline communication with their accountants through easy exports for VAT or annual reports.

Expert opinions further highlight the importance of budgeting tools in fostering economic resilience. Financial specialists advocate for the use of these resources, noting that they can fundamentally change the way independent workers manage their finances, ultimately supporting long-term success. By utilizing these tools, independent workers can navigate the complexities of their financial environment with confidence and clarity.

Moreover, as platforms like Fiverr continue to shape the freelancing market, the necessity for efficient management tools, such as Kulud, becomes increasingly apparent.

The Importance of Budgeting for Freelancers

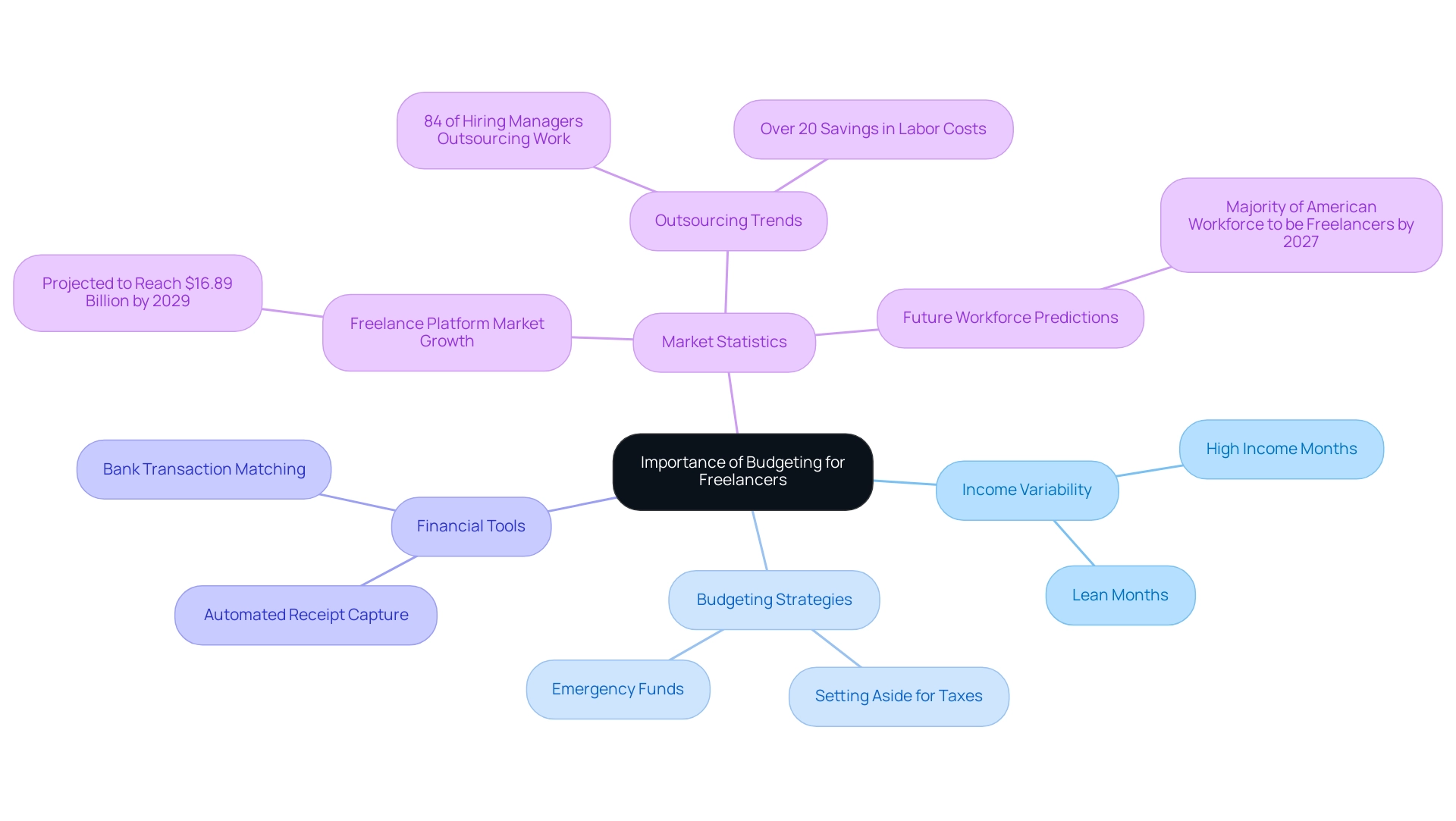

Budgeting is crucial for independent workers, particularly given the unpredictable nature of their income. Unlike conventional workers, independent contractors often experience times of high income followed by lean months, making effective resource management essential. Establishing a budget with the right tools allows independent workers to allocate funds for essential expenses, savings, and taxes, ensuring they remain financially stable despite income variability.

To combat the challenges of fluctuating income, independent workers should consider setting aside a percentage of each payment specifically for taxes. This proactive measure not only prepares them for tax obligations but also assists in building an emergency fund, which can be a monetary lifesaver during lean periods. By adopting this approach, independent workers can significantly reduce the stress associated with income fluctuations, fostering a sense of control over their economic future.

Statistics reveal that the platform market for self-employed individuals is projected to reach $16.89 billion by 2029, indicating a growing reliance on independent work. Furthermore, a survey highlighted that 84% of hiring managers in the Asia Pacific have outsourced work to independent contractors, resulting in over 20% savings in labor costs. This trend underscores the economic advantages of freelancing and the significance of sound monetary practices.

The case study named 'Freelancer Outsourcing in Asia' illustrates this point, highlighting how businesses benefit from outsourcing while independent contractors must handle their finances efficiently to seize these opportunities.

As the American labor force is anticipated to be primarily composed of self-employed individuals by 2027, the importance of financial planning becomes even more evident. Many independent workers report that utilizing budgeting tools through a structured strategy has allowed them to streamline their financial processes, ultimately leading to improved communication with accountants and better overall financial management. For instance, Akim Arhipov, a founder, noted that instead of spending 3 hours each month searching for and collecting invoices, he now spends just 5 minutes due to the new system.

This transformation is made possible through the automated receipt capture of the platform, which enables independent contractors to effortlessly scan and upload invoices, along with its bank transaction matching feature, which reconciles invoices with bank statements seamlessly.

Furthermore, testimonials from individuals new to freelancing emphasize how the platform simplifies their money management, enabling them to concentrate more on their primary work instead of being overwhelmed by accounting responsibilities.

Key Features to Look for in Budgeting Tools

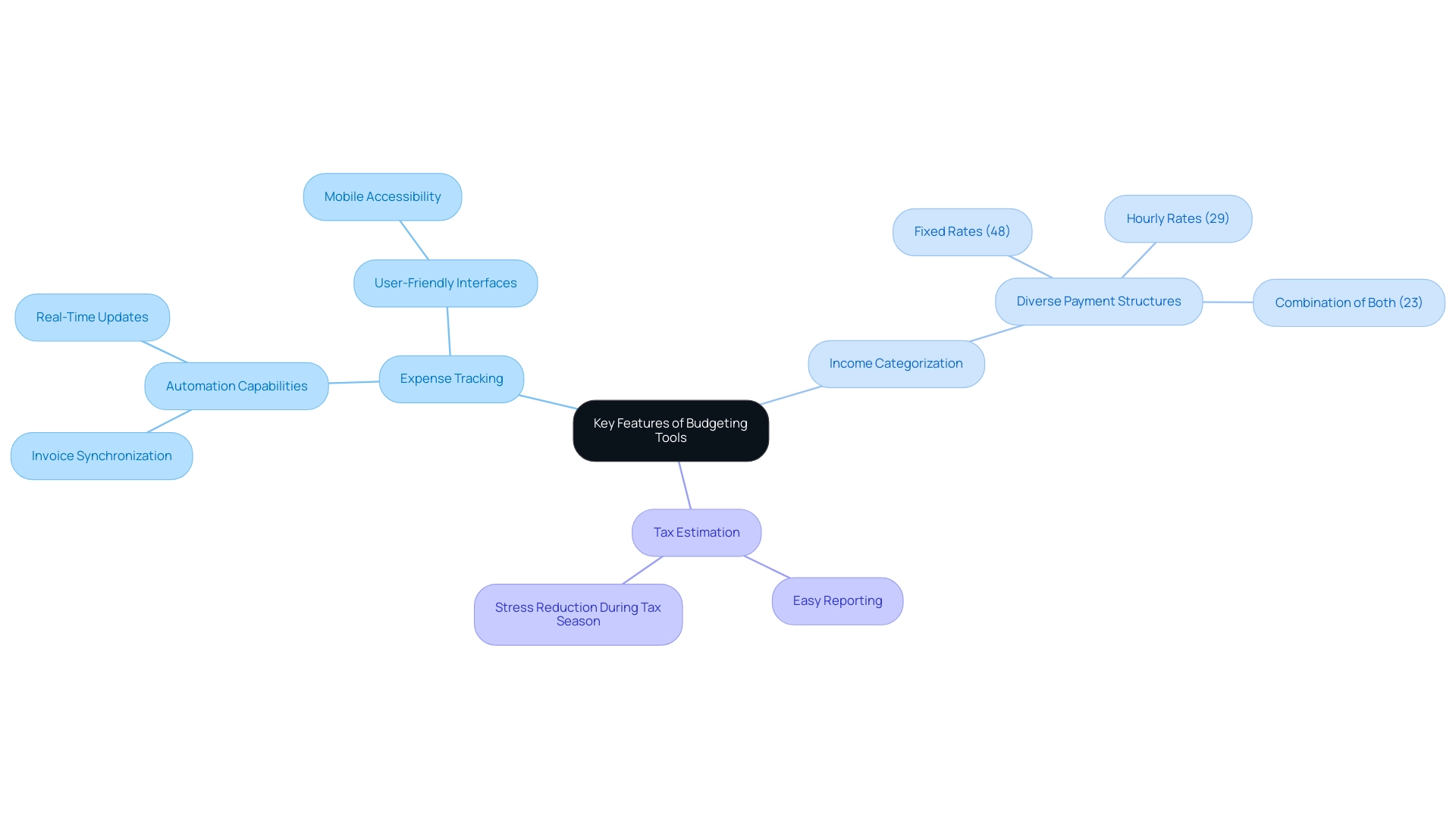

When selecting tools for budgeting, independent workers often face common concerns regarding expense management. Prioritizing essential features such as expense tracking, income categorization, and tax estimation is crucial. Automation capabilities stand out; tools like Kulud effortlessly synchronize with bank accounts, automatically capturing invoices and receipts while providing real-time updates on spending and income for more precise oversight. Users can easily log in with their business email, simplifying the management of multiple accounts.

The automatic search feature assists independent workers in quickly finding relevant invoices and receipts, streamlining their financial management. User-friendly interfaces and mobile accessibility are also vital, catering to independent workers who are frequently on the move.

In 2025, tools such as QuickBooks Self-Employed and FreshBooks are notable for their extensive features specifically tailored for independent workers. Kulud, in particular, automates the process of finding and categorizing receipts and invoices, significantly reducing the time spent on bookkeeping tasks. It links directly to your bank account, aligning invoices with transactions, and provides straightforward exports for VAT or yearly reporting. This makes it an essential resource for individuals managing multiple income streams.

Independent workers can automate invoice creation and effortlessly monitor expenses, which is especially advantageous considering that nearly 80% of them hold a bachelor’s or postgraduate degree. This indicates a highly educated workforce that values efficiency. Furthermore, statistics reveal that 48% of independent workers operate on fixed rates, while 29% charge hourly, and 23% utilize both methods. This diversity in payment structures highlights the necessity for financial tools that can adjust to different income sources. In 2022, Upwork's revenue reached $618.32 million, underscoring the growth of the gig economy and the increasing demand for budgeting tools designed for independent workers.

Financial experts recommend using budgeting tools that facilitate easy tax estimation and reporting, as these can significantly reduce the stress associated with tax season. Real-life examples illustrate the effectiveness of these tools. Many independent workers have reported that utilizing budgeting tools, including expense tracking and tax estimation features, has not only streamlined their financial processes but also improved their overall business performance. As Beth Kempton noted, "85% indicated the best days are ahead for freelancing," reinforcing the importance of having the right tools in place.

The organization, with its commitment to data security and trustworthiness, positions itself as a leading solution in this evolving landscape. As the gig economy continues to expand, with platforms such as Upwork handling $4.14 billion in total services volume in 2023, the need for efficient financial management tools designed for independent workers is more crucial than ever. Therefore, it is essential to explore these budgeting tools and consider how they can enhance your financial management.

Effective Budgeting Methods for Freelancers

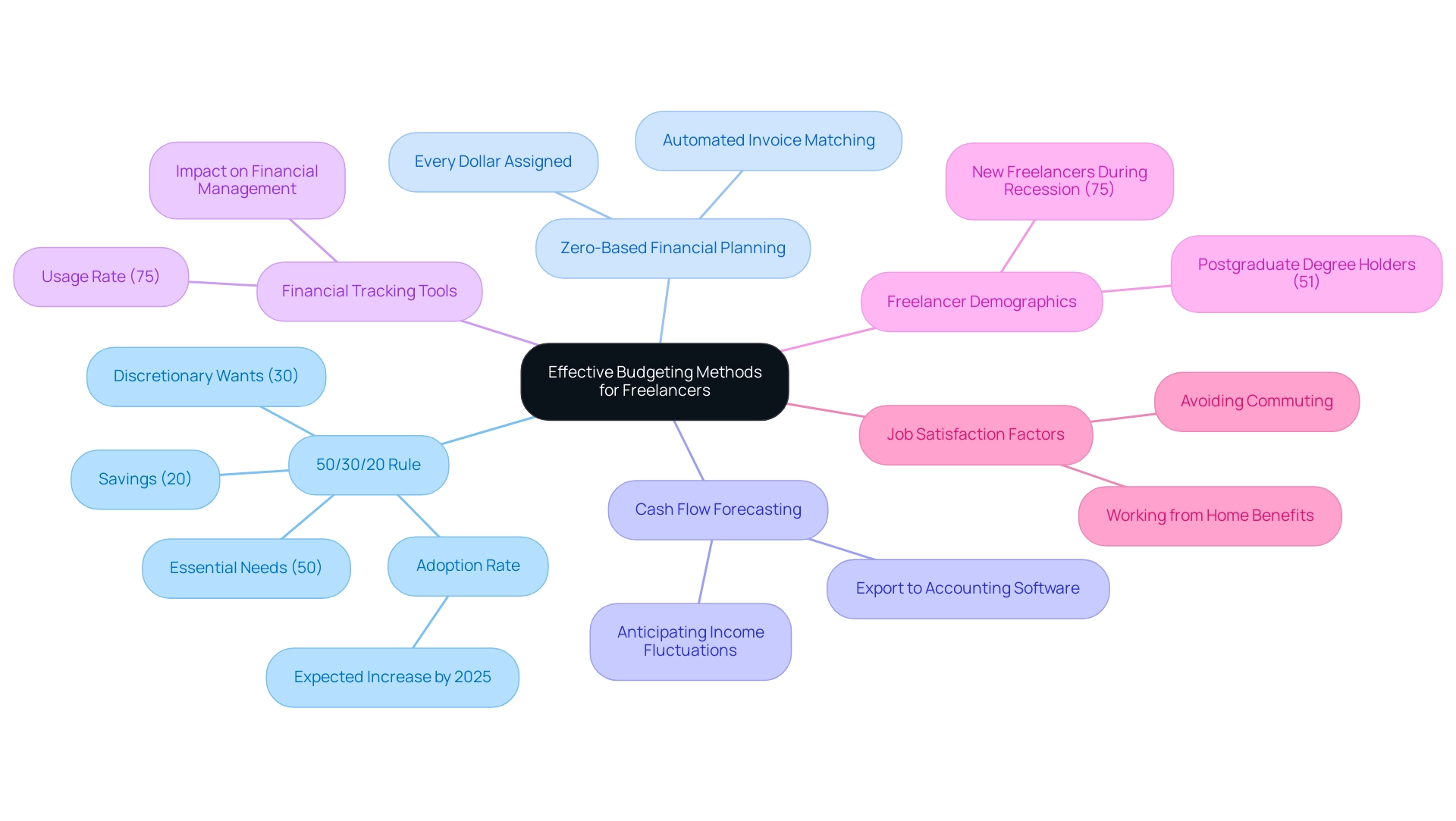

Freelancers often face challenges in managing their finances effectively. Understanding these concerns is crucial for independent workers striving for financial stability. By utilizing effective planning techniques tailored to their unique income trends, freelancers can significantly enhance their money management. Incorporating various tools can streamline this process. A widely recognized method is the 50/30/20 rule, which allocates 50% of income to essential needs, 30% to discretionary wants, and 20% to savings. This approach not only fosters a balanced financial lifestyle but also empowers independent workers to prioritize their spending wisely.

This platform allows independent professionals to log in easily with their business email, capture invoices and receipts, and automate expense tracking through an automatic search feature. Another effective strategy is zero-based financial planning, where every dollar earned is assigned to specific expenses, ensuring no funds are left unallocated. With automated matching of invoices to bank transactions, this meticulous approach helps freelancers maintain control over their finances, particularly in an environment with unpredictable income.

Additionally, creating a cash flow forecast can be invaluable for independent workers. By anticipating income fluctuations, they can plan their expenses more effectively, ensuring preparedness for leaner months. This system enhances the process by allowing easy exports to accounting software, including capabilities for VAT or annual reports, facilitating regular reviews and adjustments based on changing income or expenses.

Statistics reveal that approximately 75% of independent workers utilize tracking tools to simplify their responsibilities, underscoring the growing trend among self-employed individuals to adopt structured expense management methods. Furthermore, with 51% of individuals holding postgraduate degrees now working independently, the need for effective monetary strategies is more crucial than ever. Notably, 75% of new independents began during an economic downturn, seeking economic stability and increased freedom.

As the landscape of independent work continues to evolve, the adoption rates of the 50/30/20 rule among self-employed individuals are anticipated to rise in 2025, indicating a shift towards more disciplined financial practices. Monetary specialists emphasize that these planning techniques, supported by budgeting tools, not only promote economic stability but also empower independent workers to achieve their personal and professional goals with greater confidence. As Georgi Knyazhev noted, the transformative impact of Kulud on accounting procedures enables independent workers to save time and enhance communication with their accountants, further refining their money management capabilities.

Moreover, the tendency of independent workers to operate from home contributes to their overall job satisfaction and financial management, highlighting the importance of efficient budgeting strategies in this evolving work environment. With these insights, we encourage freelancers to explore the platform and experience its benefits firsthand.

Overcoming Budgeting Challenges as a Freelancer

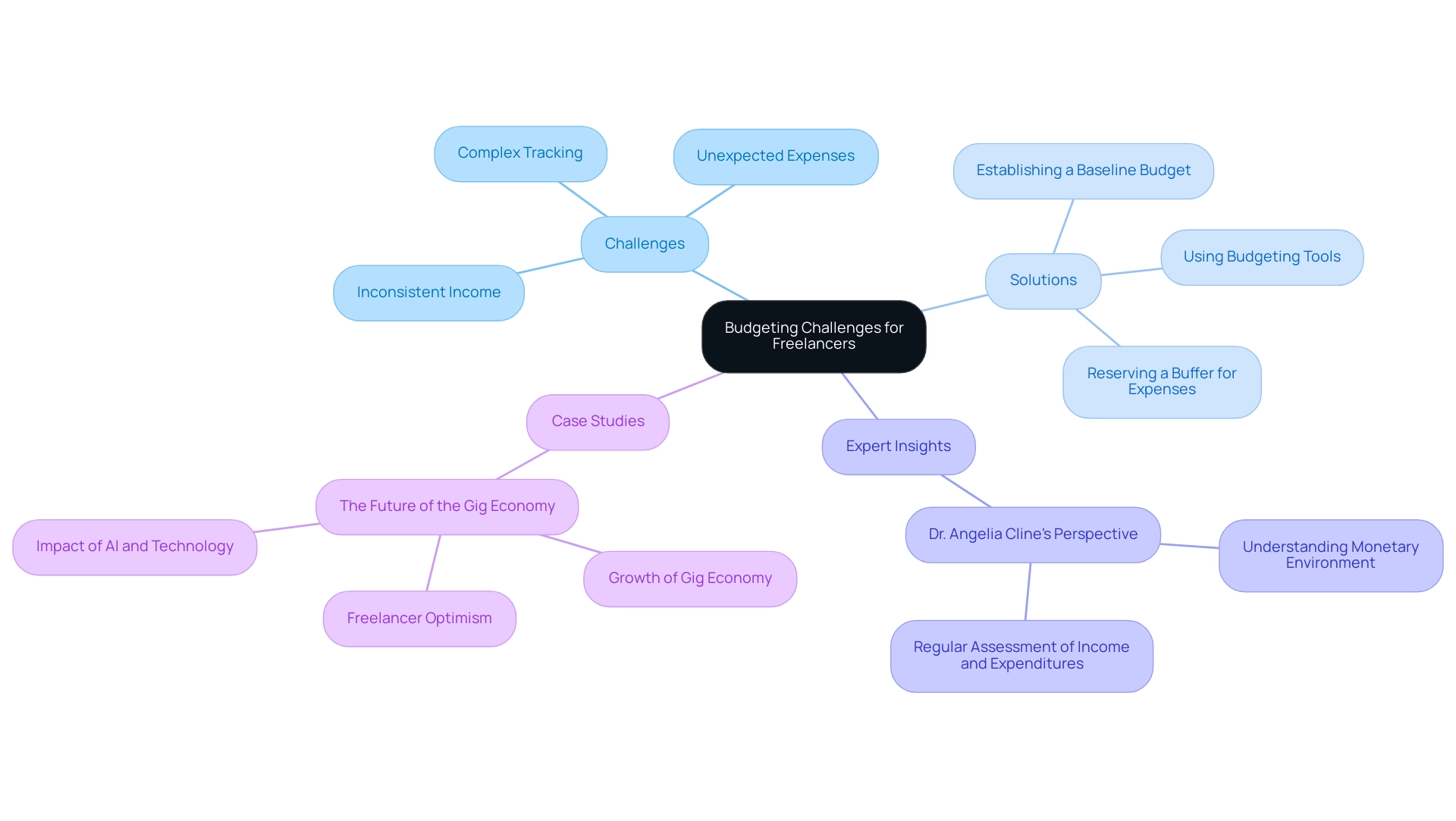

Freelancers often face challenges such as inconsistent income, unexpected expenses, and the complexities of tracking multiple income streams. In 2025, a significant percentage of freelancers—approximately 74%—express optimism about future job opportunities; however, they must navigate the economic uncertainties that accompany their work. Establishing a baseline budget based on minimum monthly expenses is crucial for independent workers.

This foundational budget serves as a monetary safety net, enabling them to plan for leaner months and manage their cash flow more effectively. Furthermore, to alleviate stress related to finances, freelancers should consider reserving a buffer for unexpected expenses. This proactive approach not only provides peace of mind but also ensures that they are prepared for any unforeseen financial demands. In addition to this, utilizing budgeting tools that automate receipt capture, match invoices with bank transactions, and simplify the export of data for VAT or annual reports can significantly enhance financial management.

This platform streamlines the process of monitoring expenses, allowing independent workers to maintain an accurate overview of their finances without the burden of manual tracking or the time-consuming search for invoices. User testimonials highlight the transformative impact of the platform on expense management:

- Akim Arhipov, a founder, shares, "Instead of spending 3 hours each month searching for and collecting invoices for my companies in Estonia, I now spend just 5 minutes. It’s a huge time saver."

These insights illustrate how Kulud assists independent workers in navigating the intricacies of planning by providing budgeting tools that directly address their money management issues.

Expert insights indicate that independent workers can benefit from implementing a structured approach to financial planning. Dr. Angelia Cline, Chief Editor for SupplyGem, emphasizes, "Freelancers must develop a clear understanding of their monetary environment to navigate the complexities of managing expenses effectively." By regularly assessing their income and expenditures and utilizing budgeting tools like Kulud for seamless integration of various revenue sources, independent workers can ensure a comprehensive view of their financial situation.

Case studies demonstrate that independent workers who employ organized planning methods report lower financial stress and improved overall economic well-being. For instance, the case study titled "The Future of the Gig Economy" highlights that as the gig economy continues to expand, driven by the rise of remote work and technological advancements, independent workers are increasingly optimistic about their future, believing that the best days for self-employment lie ahead.

In 2025, effectively tracking multiple income streams is more important than ever. By addressing budgeting challenges and implementing robust financial practices with the assistance of budgeting tools that offer easy exporting options for VAT or annual reports, independent workers can focus on their primary tasks, ultimately leading to enhanced success and stability in their careers.

Leveraging Automation in Budgeting Tools

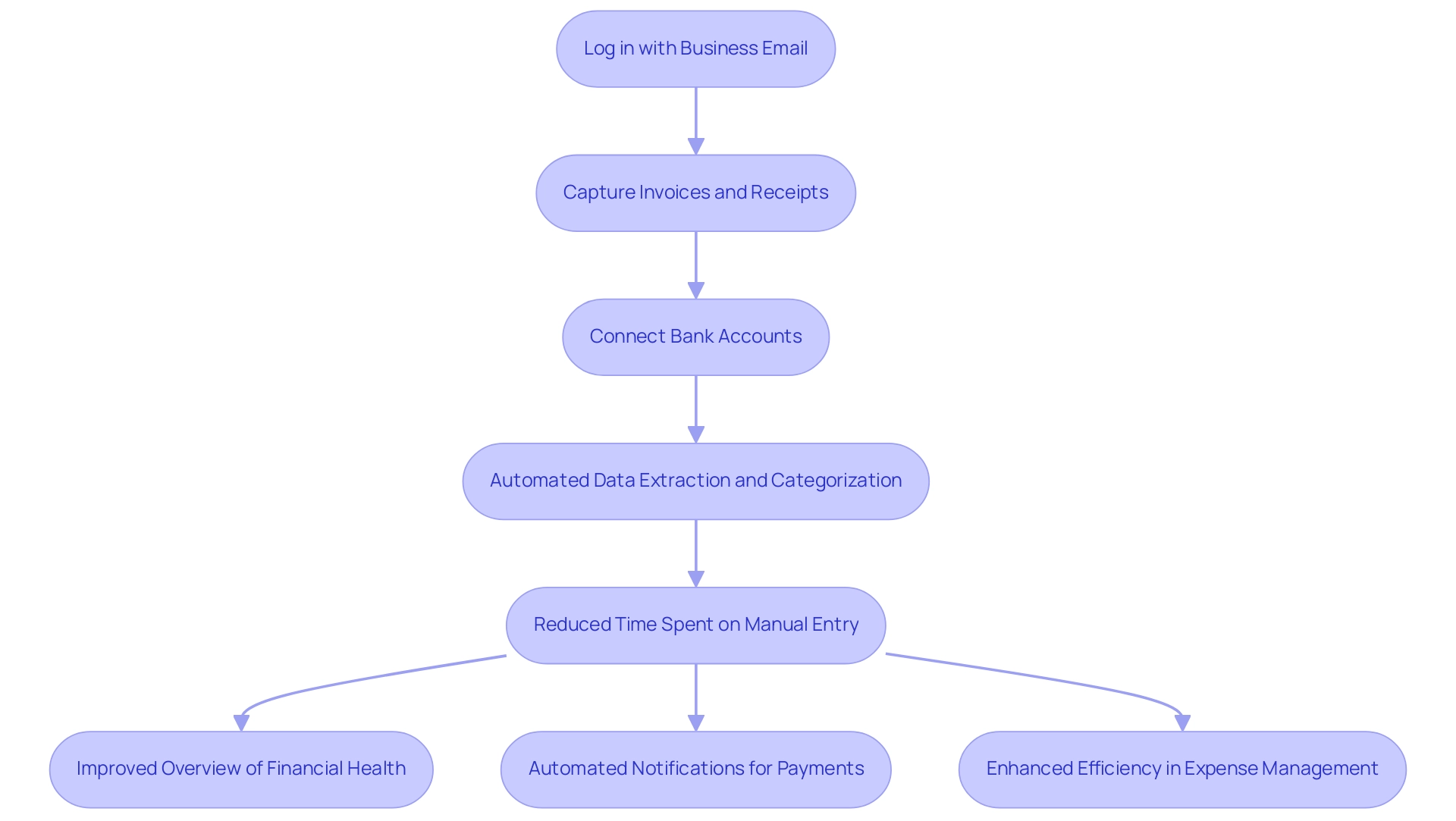

Independent workers often face significant concerns about managing their expenses effectively. Automation has transformed the way these individuals utilize budgeting tools, making it essential for efficient financial management. Platforms like Kulud streamline the expense tracking process by allowing users to:

- Log in with their business email

- Capture invoices and receipts

- Connect their bank accounts

The platform automatically extracts data from receipts and invoices, categorizes expenses, and syncs seamlessly with bank transactions.

This means that independent workers can significantly reduce the time spent on manual data entry, allowing them to focus on their core business activities while minimizing the risk of errors. By utilizing budgeting tools, they gain a comprehensive and precise overview of their economic well-being without the burden of tedious administrative tasks. Kulud exemplifies this shift with features like:

- Automatic invoice matching with bank transactions

- Enabling users to capture invoices and receipts

- Connecting their bank accounts

- Effortlessly exporting data for VAT or annual reports

Furthermore, automated notifications for bill payments and tax deadlines help independent workers stay organized and avoid costly late fees, ensuring their monetary obligations are met on time.

Looking ahead to 2025, the landscape of budgeting tools for independent workers is increasingly shifting toward automation, with statistics indicating that a significant segment of the workforce is embracing these technologies. Notably, 99% of companies are preparing for stricter disclosure requirements, underscoring the importance of automation in resource management. Financial specialists emphasize that budgeting tools, through automation in financial planning, not only enhance efficiency but also empower independent workers to make informed monetary choices based on real-time information.

As more than 50% of the US workforce is projected to engage in freelancing by 2027, the demand for effective budgeting solutions will only grow, as highlighted by Kyle Prinsloo, Founder of ClientManager. User testimonials further emphasize how the platform transforms the expense management experience for independent workers. For instance, Akim Arhipov, a founder, states, "Instead of spending 3 hours each month searching for and collecting invoices for my companies in Estonia, I now spend just 5 minutes. It's a huge time saver."

By adopting automation, independent workers can enhance their financial practices, ensuring they remain competitive and financially astute in a changing market. We invite you to explore Kulud and experience the benefits of streamlined expense management for yourself.

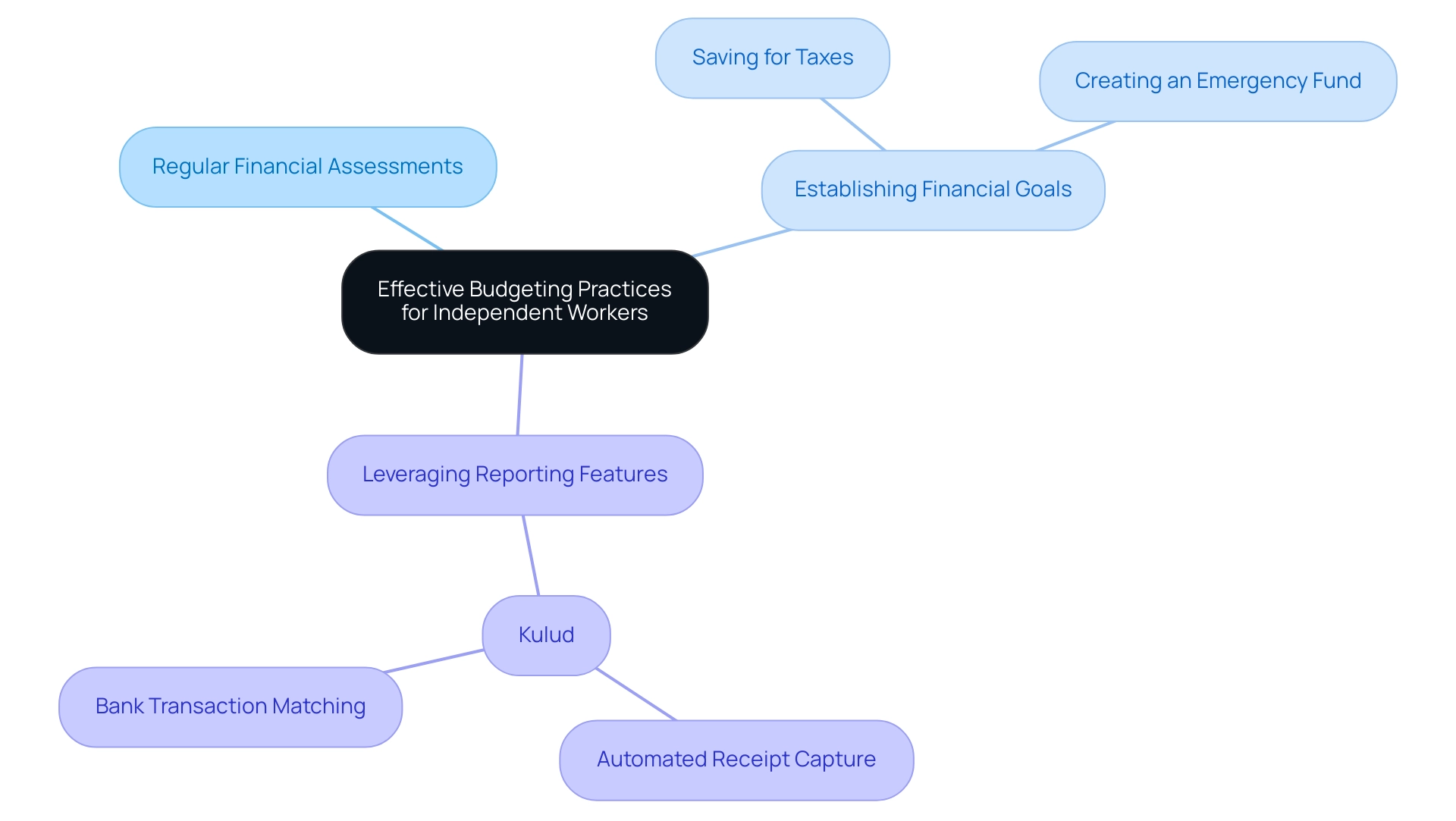

Best Practices for Using Budgeting Tools Effectively

To enhance the efficiency of budgeting tools, independent workers should prioritize regular assessments of their finances, making necessary modifications in response to changes in income and expenses. Establishing clear financial goals—such as saving for taxes or creating an emergency fund—serves not only as motivation but also as a roadmap for financial success. With approximately 60% of self-employed individuals neglecting to track their expenses, leveraging the reporting features of budgeting tools becomes crucial for gaining insights into spending habits and identifying areas for improvement.

In this context, Kulud emerges as an invaluable resource for independent workers, offering automated receipt capture and seamless bank transaction matching. By securely connecting their bank accounts, freelancers can effortlessly match invoices with transactions, simplifying the tracking and categorization of expenses. Users can log in with their business email, select date ranges, or enable automatic searches for convenience.

This automated expense management solution not only ensures data security through advanced encryption but also allows for easy exporting of monetary data for VAT or annual reporting, streamlining the accounting process. The organization has undergone a comprehensive Cloud Application Security Assessment (CASA) by Google and has been validated by the App Defense Alliance (ADA), ensuring that user data remains confidential and secure.

As the U.S. continues to dominate the global gig economy, accounting for 44% of its volume in 2025, the necessity for effective resource management becomes increasingly apparent. Freelancers can benefit from adopting best practices in financial planning, such as utilizing automated budgeting tools like Kulud that enhance expense tracking and categorization. Rebekkah Smith, a previous author and SEO Expert at North One, stresses that "effective budgeting is crucial for independent workers to manage the uncertainties of gig work and ensure economic stability."

Real-life examples illustrate how independent workers have successfully adjusted their budgets in response to income changes, showcasing the adaptability required in this dynamic work environment.

The case study on the U.S. contribution to the global gig economy emphasizes the significance of efficient monetary management in an expanding market, reinforcing the need for independent workers to remain proactive. Economic specialists highlight that remaining involved in the planning process is crucial for independent workers to stay aligned with their monetary goals. By embracing these strategies and effectively utilizing budgeting tools, freelancers can alleviate financial stress and foster a more sustainable business model.

Kulud, built by top founders and tech professionals from the Baltics & Nordics, stands as a trusted solution in this evolving landscape.

Conclusion

Freelancers are increasingly aware of the challenges they face in managing their finances, particularly when it comes to budgeting effectively. This article highlights how tools like Kulud and YNAB empower independent workers by:

- Streamlining expense tracking

- Automating tedious tasks

- Facilitating better financial oversight

With the gig economy projected to grow significantly, harnessing these budgeting tools is essential for freelancers aiming for financial stability and success.

Implementing structured budgeting strategies, such as the 50/30/20 rule or zero-based budgeting, allows freelancers to:

- Allocate their income wisely

- Prepare for taxes

- Build emergency funds

Furthermore, by leveraging automation in budgeting tools, freelancers can save valuable time and alleviate the stress associated with managing fluctuating incomes. Real-life testimonials and expert insights demonstrate that utilizing these tools not only enhances financial management but also leads to improved productivity and peace of mind.

In conclusion, as freelancing continues to reshape the workforce, adopting effective budgeting practices and utilizing the right tools is crucial for financial resilience. Embracing automation and establishing a clear financial roadmap can empower freelancers to navigate their financial landscape with confidence. Ultimately, this enables them to focus on what they do best—delivering exceptional work in a rapidly evolving economy.